Accounts receivable is a critical aspect of a company’s financial operations, representing the balance of money due to the firm for goods or services delivered but not yet paid by customers. But wait, you might still be asking, what is accounts receivable? Let’s dive into that question, the definition, examples, and use cases that highlight its importance for businesses.

Understanding accounts receivable is essential for maintaining healthy cash flow and working capital management. Additionally, we will discuss Alternative Payments accounts receivable automation software as a solution for efficient AR management, offering useful tips on optimizing this crucial process.

Understanding the Accounts Receivable Process

The accounts receivable process encompasses several key steps for managing a business’s financials. Here’s an overview of the process:

- Sales: The process begins with a sale, where goods or services are provided to customers. Typically, cash is not exchanged immediately, which creates a “credit” sale, allowing your client to make payments later. This transaction results in the creation of an account receivable for the business.

- Invoices: Following the sale, invoices are issued to the customers, and outline purchase details, payment terms, and the amount due.

- Payment Terms and Extended Payment Periods: Payment terms specify the period within which the customer is expected to settle the outstanding amount. Some businesses may offer extended payment periods to encourage larger purchases or foster long-term customer relationships.

Building strong customer relationships is critical in this context as it can positively impact accounts receivable management. Maintaining open lines of communication and understanding your customers’ payment preferences can lead to timely payments and improved cash flow management. A proactive approach to address potential payment delays or disputes can also help maintain healthy accounts receivable.

Understanding these steps and terms is fundamental for businesses aiming to effectively manage their accounts receivable and maintain a healthy cash flow while nurturing positive customer relationships.

While managing your costs and expenses appears as being a sound strategy to increase profitability, accounts receivable software is where your business will see the greatest impact. It's simple, AR will always be a larger line item than AP.

Importance of Accounts Receivable for Business Growth

Proper accounts receivable management is vital for businesses as it directly impacts their cash flow and working capital. By ensuring the timely collection of outstanding payments, companies can optimize their cash flow, which is vital for meeting day-to-day operational expenses and pursuing growth opportunities. Moreover, efficient accounts receivable management allows businesses to maintain healthy working capital levels, providing the financial flexibility to invest in expansion initiatives, research and development, and other strategic ventures.

How Effective Accounts Receivable Management Improves Cash Flow

Businesses across various industries have leveraged effective accounts receivable strategies and accounts receivable software to drive their growth. For instance, a manufacturing company streamlined its invoicing and collection processes, resulting in a significant reduction in overdue payments and an increase in available working capital.

This enabled the company to ramp up production, fulfill larger orders, and expand its market reach. Similarly, a technology startup implemented rigorous credit policies and proactive collection measures, which minimize bad debt losses and empower the business to scale its operations and launch new product lines. By strategically managing accounts receivable, organizations can bolster their financial foundation, seize growth opportunities, and navigate economic challenges more effectively.

These case studies illustrate how businesses utilize accounts receivable strategies to fuel growth.

Accounts Receivable on the Balance Sheet and Its Impact on Financial Health

Accounts receivable are essential to a company’s financial health and exist on the balance sheet. Here’s a closer look at how accounts receivable are presented on the balance sheet and what they tell us about a company’s finances:

1. Accounts Receivable as a Current Asset

On the balance sheet, accounts receivable are categorized as a current asset. This means that it represents money owed to the company that is expected to be collected within a short period, usually one year or less. It’s an important element of a company’s readily available resources and ability to cover immediate expenses.

2. Indication of Credit Sales

Accounts receivable listed on the balance sheet indicate that the company has made sales on credit. This means that customers have been given the option to purchase goods or services with an agreement to pay later. Including accounts receivable in the balance sheet reflects these credit sales and shows the company has an active customer base.

3. Insights into Financial Position

The amount of accounts receivable on the balance sheet can give us insights into a company’s financial position. Here’s how:

- Higher balances in accounts receivable may suggest that the company has given its customers more time to make their payments or that some customers have not yet paid their dues.

- Lower balances in accounts receivable, faster payment collection, and better financial management.

By analyzing balances over time and comparing them with industry benchmarks, we can assess how well a company manages its credit policies and collection efforts.

4. Evaluation of Collection Efficiency

Monitoring the age of accounts receivable helps us evaluate how efficiently a company collects payments from its customers. The balance sheet may provide information about different categories of accounts receivable based on their payment status, such as current or past due amounts. This data allows us to:

- Identify any overdue payments and take appropriate actions to collect them.

- Measure the average number of days it takes for customers to settle their outstanding balances.

Keeping a close eye on these collection metrics enables companies to improve cash flow by minimizing delayed payments.

5. Effective Cash Flow Management

Keeping track of accounts receivable on the balance sheet is crucial for effective cash flow management. By closely monitoring outstanding invoices and promptly collecting payments, businesses can:

- Ensure they have enough cash to cover their expenses and financial obligations.

- Plan for future investments or growth opportunities based on their projected cash inflows.

Optimizing the AR turnover ratio (the rate at which they convert credit sales into cash) enhances a company’s financial stability and performance.

Understanding how accounts receivable are presented on the balance sheet gives us valuable insights into a company’s financial health. It reveals important aspects such as sales visibility, collection efficiency, and cash flow management. By actively managing accounts receivable, businesses can strengthen their financial position and drive sustainable growth.

Experience payment simplicity at its finest!

Key Metrics for Evaluating Accounts Receivable Performance

When evaluating the performance of accounts receivable management, there are some key metrics that businesses rely on — average accounts receivable, accounts receivable turnover ratio, and days sales outstanding (DSO).

Average Accounts Receivable

Average accounts receivable measures how efficiently a company collects customer payments. A higher average likely demonstrates greater sales on credit or slower collection, while a lower average could imply less credit sales or quicker collection. To determine the average AR, one adds the initial and final receivables within a designated timeframe—typically monthly, quarterly, or annually—and then divides the total by two. This is perhaps the most common calculation for average accounts receivable.

Average AR = (Beginning Accounts Receivable + Ending Accounts Receivable) ÷ 2 | Formula

It’s important to remember that when calculating this every month, this approach may yield a somewhat high average receivable since many companies tend to issue invoices at month-end but cover the period over which receivables are currently outstanding.

To better understand how this metric looks fleshed out, imagine a company that has the following accounts receivable balances:

Company A

Beginning AR at the start of the year: $80,000

Ending AR at the end of the year: $120,000

Average Accounts Receivable = ($120,000 + $80,000) ÷ 2

Average AR = $100,000

This indicates that, on average, the company had $100,000 owed to it by its customers over the given period (in this case, a year).

Accounts Receivable Turnover Ratio

The accounts receivable turnover ratio measures how efficiently a company collects customer payments. In financial forecasting, experts employ the accounts receivable turnover ratio to project future balance sheet figures. It is calculated by dividing the net credit sales by the average accounts receivable during a specific period.

AR Turnover Ratio = Net Credit Sales ÷ Average AR | Formula

A high turnover ratio indicates that a company is collecting payments quickly, while a low ratio suggests that collections are taking longer.

So, what does this look like for Company A?

Company A

Net Credit Sales: $600,000

Average Accounts Receivable: $100,000

Accounts Receivable Turnover Ratio = $600,000 ÷ $100,000

AR Turnover Ratio = 6

This means the company collects its average receivables 6 times a year.

Days Sales Outstanding (DSO)

Days sales outstanding (DSO) is another important metric that provides insight into the average number of days it takes for a company to collect payment after making a sale. It is calculated by dividing the days in a given period by the AR turnover ratio.

DSO = Number of Days ÷ AR Turnover Ratio | Formula

A lower DSO indicates that a company collects payments more rapidly, which is generally preferred as it improves cash flow. On the other hand, a higher DSO suggests that collections are taking longer.

Now, let’s calculate the DSO for Company A:

Company A

Number of Days: 365

AR Turnover Ratio: 6

Days Sales Outstanding = 365 ÷ 6

DSO = 60.83 days

This result suggests it takes Company A on average about 61 days to collect its receivables.

By analyzing these metrics, businesses can gain valuable insights into how efficient their AR management is and identify areas for improvement.

Potential Challenges in Accounts Receivable and How to Mitigate Them

Accounts receivable management comes with its fair share of challenges. It is important for businesses to be aware of these risks and have strategies in place to mitigate them.

Here are some common AR challenges and how to address them:

Delinquent payments

One of the biggest challenges is dealing with customers who fail to make timely payments. This can disrupt cash flow and impact the financial health of the business. To mitigate this risk, consider implementing the following strategies:

- Clearly define payment terms and communicate them to customers upfront.

- Send timely reminders and follow-ups on overdue payments.

- Offer incentives for early payment, such as discounts or rewards.

- Establish a process for escalating non-payment issues, including involving collection agencies if necessary.

Bad debt losses

Another challenge is the risk of bad debt, where customers are unable or unwilling to pay their outstanding invoices. This can result in a significant financial loss for the business. To minimize bad debt losses, consider the following measures:

- Conduct thorough credit checks before extending credit to new customers.

- Set credit limits based on the customer's creditworthiness.

- Regularly review and update credit terms for existing customers.

- Monitor customer payment patterns and identify any signs of financial distress early on.

By implementing proactive credit policies, effective collection procedures, and closely monitoring customer payment behaviors, businesses can successfully mitigate these challenges and improve their accounts receivable management.

Every business may face unique challenges such as industry, customer base, and economic conditions. It’s essential to continuously evaluate your accounts receivable processes and adapt your strategies to ensure healthy cash flow and risk mitigation.

Make it easy on yourself to get paid — instant cash flow!

Innovative Solutions for Streamlining Accounts Receivable Processes

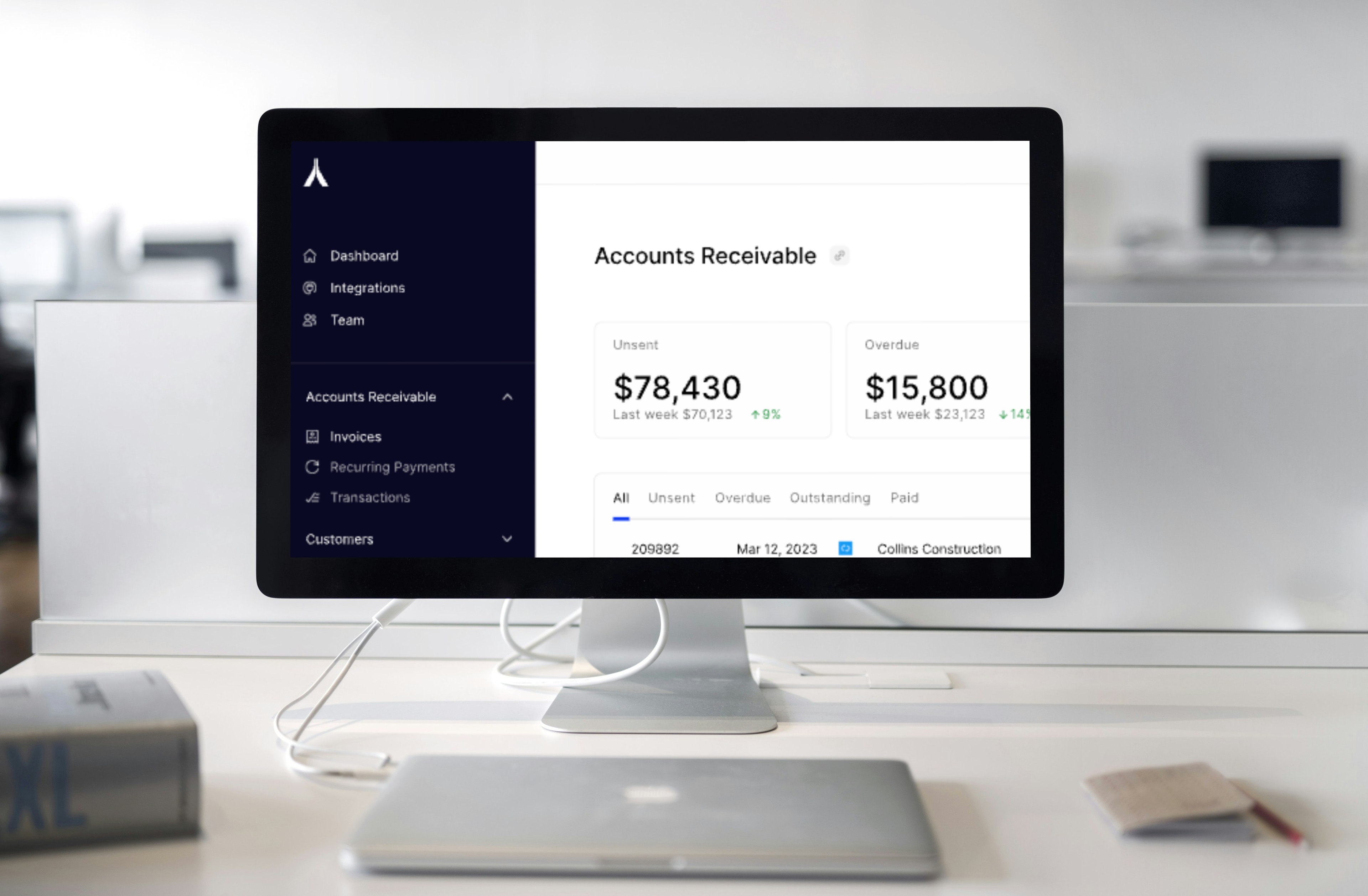

Modern technology solutions have revolutionized accounts receivable management, offering efficient and accurate handling through AR management software and automation tools.

AR Management Software

Advanced software platforms are designed to streamline the entire AR process, from invoicing to payment collection. These systems often integrate with accounting software and CRM platforms, providing a holistic view of customer accounts and outstanding balances. Additionally, they automate routine tasks, such as invoice generation and payment reminders, reducing manual errors and saving time.

Automation Tools

Automation tools play a pivotal role in optimizing accounts receivable operations. They enable businesses to automate repetitive tasks, such as sending payment confirmations and reconciling accounts; thus, improving efficiency and turnaround times. Furthermore, automation minimizes the likelihood of human error, ensuring accuracy in financial records.

Leveraging technology for AR optimization offers several benefits:

- Enhanced Efficiency: Automation streamlines processes, reducing the time and effort required for manual tasks.

- Improved Accuracy: Software solutions minimize errors, ensuring precise financial records.

- Better Cash Flow Management: Streamlined AR processes lead to quicker invoice processing and payments, positively impacting cash flow.

These innovative solutions empower businesses to efficiently manage their accounts receivable, contributing to improved financial health and operational agility.

Accounts Receivable at Alternative Payments

Accounts receivable is a key financial pillar for businesses, serving as a revenue metric that directly impacts a company’s financial health and growth. Efficient accounts receivable management improves cash flow and working capital management, allowing businesses to allocate resources more effectively.

Alternative Payments accounts receivable automation software offers a solution for streamlining AR processes, enhancing efficiency, accuracy, and cash flow management. By leveraging technology and automation tools, businesses can optimize their accounts receivable processes, reduce manual errors, and drive business growth.

The next step to improve your AR management is learning more about how Alternative Payments automation software can help you streamline your processes, improve cash flow management, and propel your business forward.

FAQs (Frequently Asked Questions)

What is the importance of understanding accounts receivable for businesses?

Understanding accounts receivable is crucial for businesses as it directly impacts their financial health. It allows companies to track the money owed to them by customers, manage cash flow effectively, and make informed decisions to support business growth.

What are the key steps involved in managing accounts receivable?

The key steps in managing accounts receivable include credit sales, issuing invoices, setting payment terms, and monitoring extended payment periods. Building strong relationships with customers is also essential in this process.

How can effectively managing accounts receivable contribute to business growth?

Effective accounts receivable management can contribute to improved cash flow and working capital management, which are fundamental for fueling business growth. Case studies have shown how businesses utilize AR strategies to drive their expansion.

How are accounts receivable reported on the balance sheet and what does it reveal about a company’s financial position?

Accounts receivable are reported as an asset on the balance sheet, and they reflect the amount of money owed to the company by its customers. The balance of AR can indicate the efficiency of a company’s credit policies and collection procedures.

What are the key metrics used to evaluate accounts receivable performance?

When evaluating accounts receivable performances, important metrics are average AR, AR turnover ratio, and days sales outstanding (DSO). These metrics help assess how efficiently a company manages its AR when collecting customer payments.

What are potential challenges in accounts receivable and how can they be mitigated?

Common challenges in accounts receivable include delinquent payments and bad debt losses. These challenges can be mitigated through proactive credit policies, effective collection procedures, and leveraging technology solutions such as AR management software.

What are some innovative solutions for streamlining accounts receivable processes?

Modern solutions such as AR management software and automation tools can enhance efficiency and accuracy in handling accounts receivable. These solutions offer benefits that improve cash flow management and streamline AR processes.

Why is accounts receivable considered a key revenue metric for businesses?

Accounts receivable is a key revenue metric because it represents the money owed to a company for goods or services rendered. It directly impacts a company’s cash flow and overall financial performance.