You might associate the concept of accounts receivable (AR) with something as dry-sounding as accounting, especially the way it conjures a grayish or monotoned aura. That being said, considering how cash flow is the lifeblood of any business, accounting receivables is a defining indicator of a company’s financial health. It’s the money customers owe you for your goods and services.

Is Accounts Receivable an Asset?

If you’ve been questioning, “Is Accounts Receivable an Asset?” the answer is an unequivocal yes. In theory, you can gain a competitive advantage over your competitors when effectively managing your cash flow and allocating a proper level of vigilance. However, this is easy to mismanage or fail to stay on top of which could lead to devastating consequences for your company’s bottom line.

By leveraging accounting receivables effectively, you can transform it into a strategic asset for your business. A robust accounting receivables system fosters customer loyalty, increases efficiency and cash flow, and helps future-proof your business. Digitization and automation are key to achieving this transformation.

Accounts Receivable: The Hidden Asset

Until now, accounts receivable has remained anything but a priority. A powerful force multiplier, this line item can revolutionize your financial ecosystem. When managed effectively, accounting receivables can even become a key business differentiator. This is especially the case when you rely as a business on recurring payments made through invoice processing instead of invoice automation.

As already noted above, accounts receivable is the money that you are owed by your customers for goods or services provided and exists in the form of invoices and payments outstanding. It’s classified as a current asset on your balance sheet and plays a crucial role in boosting your cash flow. Unlike liabilities that represent costs to be paid, AR is not a debt you owe but an income you anticipate.

The Importance of Accounts Receivable for B2B Businesses

Efficient accounts receivable processes set your business apart, particularly for enterprises operating in the B2B arena. It serves as a bridge between your front and back office, connecting sales and collections. Plus, streamlined accounting receivables processes improve efficiency and enhance the customer experience.

Accounts Receivable is not a Liability

For starters, Accounts Receivable often gets confused as a liability; it’s an asset that offers economic benefits. Contrary to liabilities that represent costs, AR generates cash. It’s not a debt you owe, but money owed to you. On financial statements, AR is recorded as an asset, not revenue, reflecting its role in boosting cash flow. Therefore by definition, AR is money owed to a company by its customers — the individuals or corporations who buy goods or services on credit.

Accounts Receivable isn’t just an asset; it’s the engine that drives your B2B business.

Understanding Accounting Receivables: More than just an Asset

Assets, like accounts receivable, offer economic benefits. However, it’s essential to note that accounts receivable is different from liabilities. In the case of accounting receivables, it generates cash. On the other hand, liabilities represent costs to be paid. AR is not a debt you owe but is money owed to you. It’s recorded as an asset, not revenue, on financial statements (a concept known as accrual accounting). It’s classified as a current asset on a company’s balance sheet and plays a crucial role in increasing cash flow. To account for potential losses, businesses also establish an allowance for doubtful accounts (AFDA).

Often overlooked, effective accounting receivables management can yield numerous benefits for your business. It’s an engine that drives your business forward. It represents the bridge between your front (sales) and back (collections) office, acting as a key differentiator for your business. Efficient AR processes not only enhance your cash flow but also strengthen your customer relationships and improve your company’s overall efficiency. Moreover, by digitizing your accounting receivables processes, you can significantly reduce collection and management costs.

Reaping the Benefits of Effective Accounting Receivables Management

As a result of effective accounting receivables management, you can forecast your cash flow and working capital more accurately. Cash forecasting in particular is noticeably more accurate with detailed accounting receivables reports. Despite what you may think, it’s not just about the cash. Customer relationships strengthen as a result of the way a positive accounts receivables experience forges an enhanced trust dynamic. Moreover, the digitalization of AR lowers collection and management costs.

Effective accounting receivables management is critical for B2B businesses. Clear credit policies and early payment incentives can improve accounts receivables processes. Emphatically, we encourage further exploration of accounts receivable best practices and the adoption of innovative solutions like Alternative Payments for seamless accounting receivables management.

Transforming Accounting Receivables Analytics into a Strategic Asset

We believe in the power of AR as a strategic asset. Turning AR into a strategic asset can enhance customer value and relationships, increase efficiency and cash flow, and future-proof your business. Implementing AR automation can streamline collections and foster long-term success.

With the right approach, AR can transform from a simple accounting function to a strategic asset. Enhanced customer value and relationships, increased efficiency and cash flow, and future-proofing your business are all attainable through effective AR management. Automation and digitization are the keys to this transformation.

Tracking Accounting Receivables Performance Metrics

Understanding key accounts receivable terms and KPIs is crucial for effective management. If you begin to wet your beak then you might be asking questions such as what is accrual basis accounting? What does allowance for doubtful accounts entail?

To optimize your accounting receivables management, it’s important to track key performance metrics. These are just a few of the concepts to familiarize yourself with as you navigate the world of AR:

- Day Sales Outstanding (DSO)

- Collection Effectiveness Index (CEI)

- Average Days Delinquent

- Percentage of High-Risk Accounts

- Bad Debt to Sales Ratio

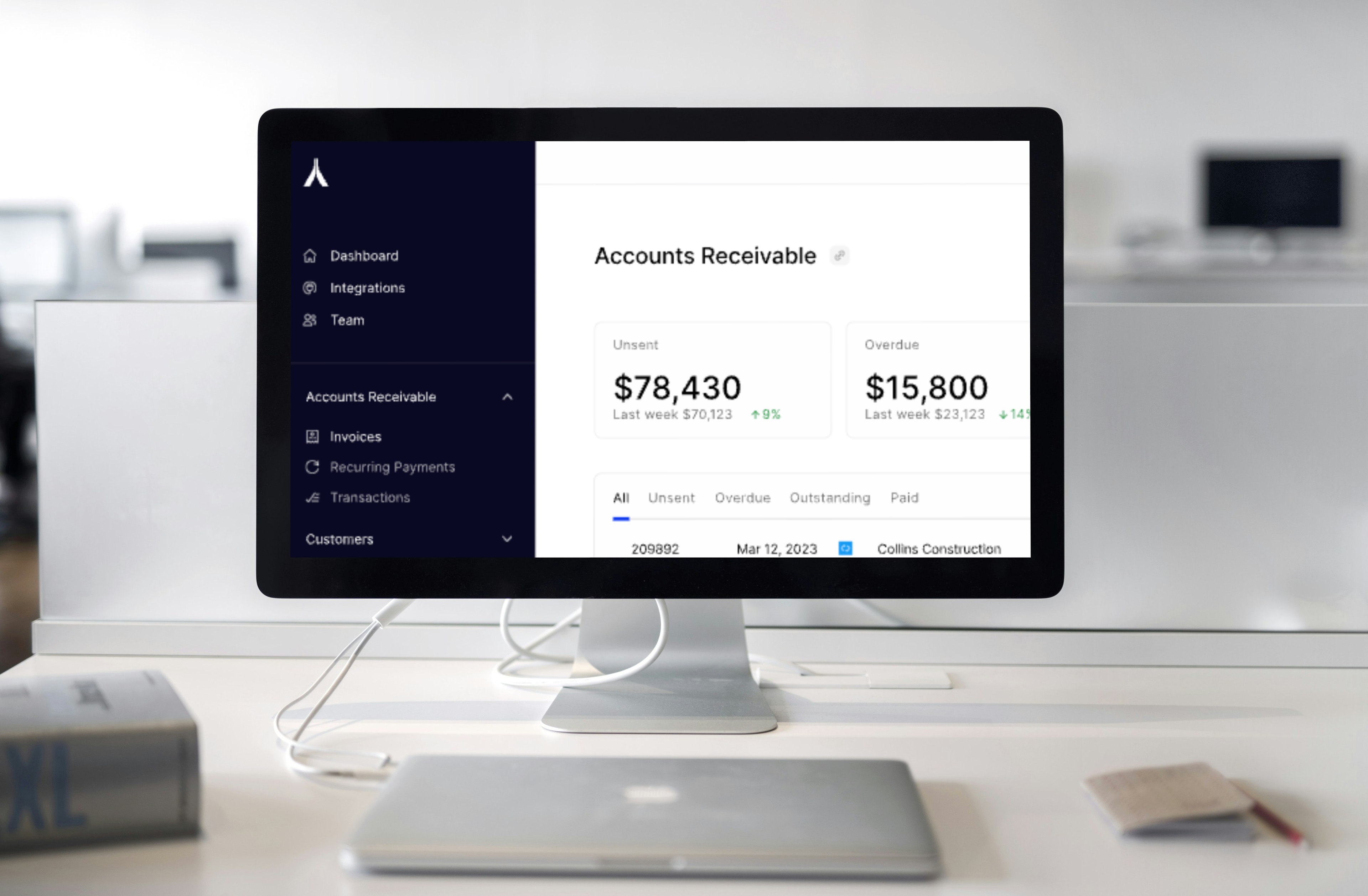

At Alternative Payments, we’re more than just a payment gateway. We are your growth partners, offering an agile platform that adapts to your needs. Our accounts receivable automation software will maximize your working capital, simplify your financial ecosystem, and propel your business forward.

To fully leverage the power of accounts receivable accounting, businesses should continue to explore and implement accounting receivables best practices. Let us show you the difference a customer-centric fintech solution can make.

Questions Answered:

What is accrual basis accounting?

Accrual basis accounting recognizes revenue when it’s earned and expenses when they’re billed, not when cash is exchanged. This method of accounting shows you a more complete picture of your company’s financial health.

What is an allowance for doubtful accounts?

An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts expected to be collected. It represents the amount of receivables believed to be uncollectible.