Accounts receivable vs payable software represent two pivotal components of the financial tech stack but don’t forget that they are quite different. It is easy to conflate the two; however, the technology solutions that exist to manage these two FinOps functions correspond in kind. In reality, there are stark and fundamental differences from their intent to their feature-benefit value.

Therefore, we’re going to dive into these differences and clarify any confusion about how each software serves distinctly different business needs. Of course, there will be a special focus on the service businesses Alternative Payments supports.

Legislative Reforms Catalyzed Industry Innovation

The Dodd-Frank Act broke barriers set by traditional banks and credit companies, fostering accountability and transparency in finance. Now, couple that with the US representing 40% of the $125 trillion B2B transaction volume. This itself represents twice the size of the consumer segment according to a Manhattan Venture Partners report on B2B payment innovation. Their research also cited another interesting point of fact, roughly 87% of all global transactions remain uncarded (including ACH or cash/check). This pivotal shift is sparking a revolution in fintech and banking, with platforms like Alternative Payments overcoming old hindrances to welcome new competition and creativity.

Accounts Receivable Software: Simplifying End-Customer Payments and Your Revenue

Definition and Purpose

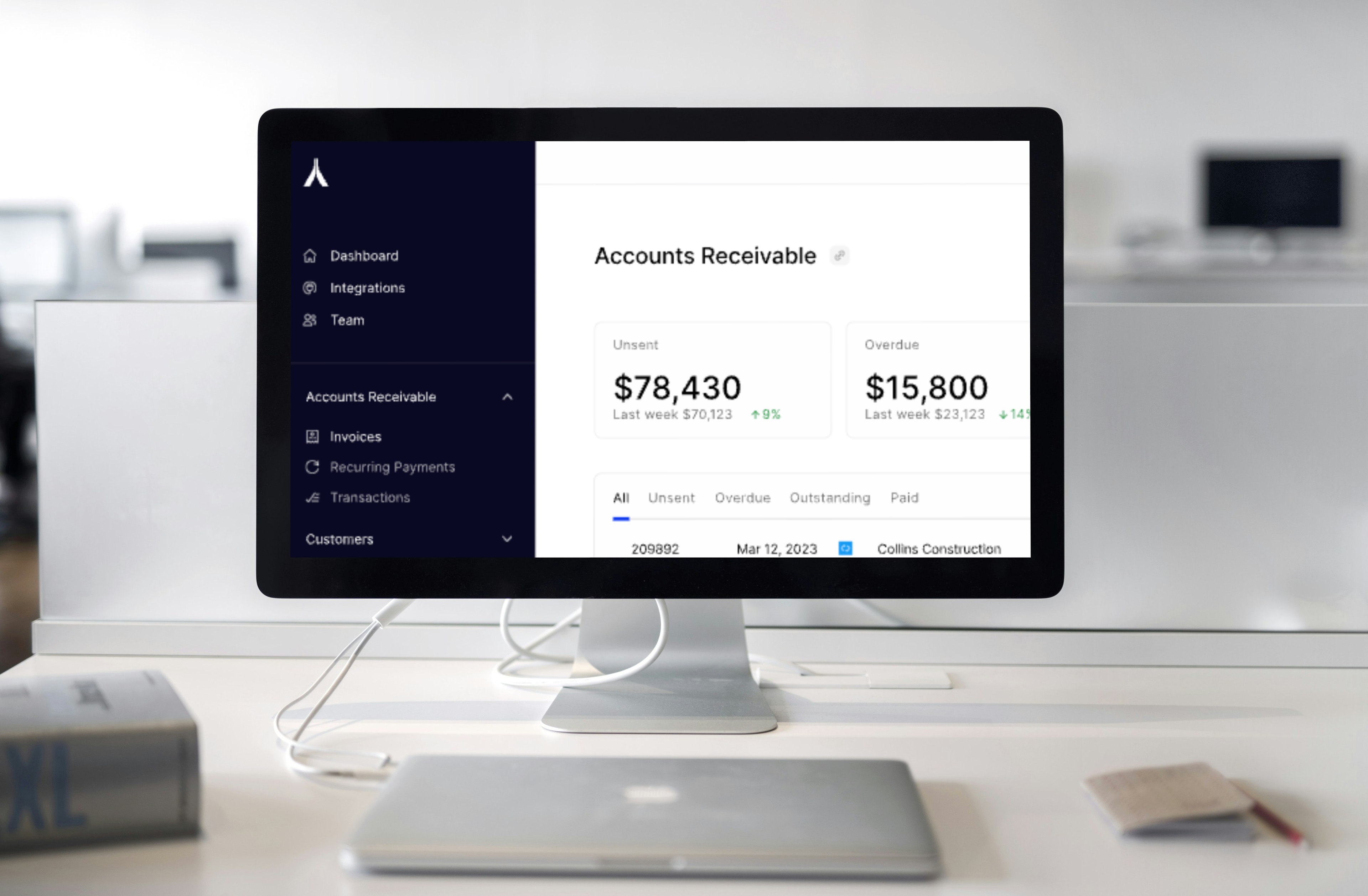

Accounts Receivable Software helps businesses manage money owed for goods or services delivered to clients. Its influence is greatest in tracking invoices and collections if needed. This assures revenues are recognized and collected at the earliest possible time.

Key Features in AR Software

- Invoice Management: Accounts receivable software allows businesses to generate, share, and track invoices, capturing nearly all billing-related events with precision; hence, ensuring customers are billed on time and accurately. This is critical for cash flow and provides clarity regarding outstanding payments.

- Payment Processing: Accounts receivable software includes different payment modes, like ACH, credit cards, and installment facilities. These provide customers the flexibility to increase their chances of receiving on-time payments.

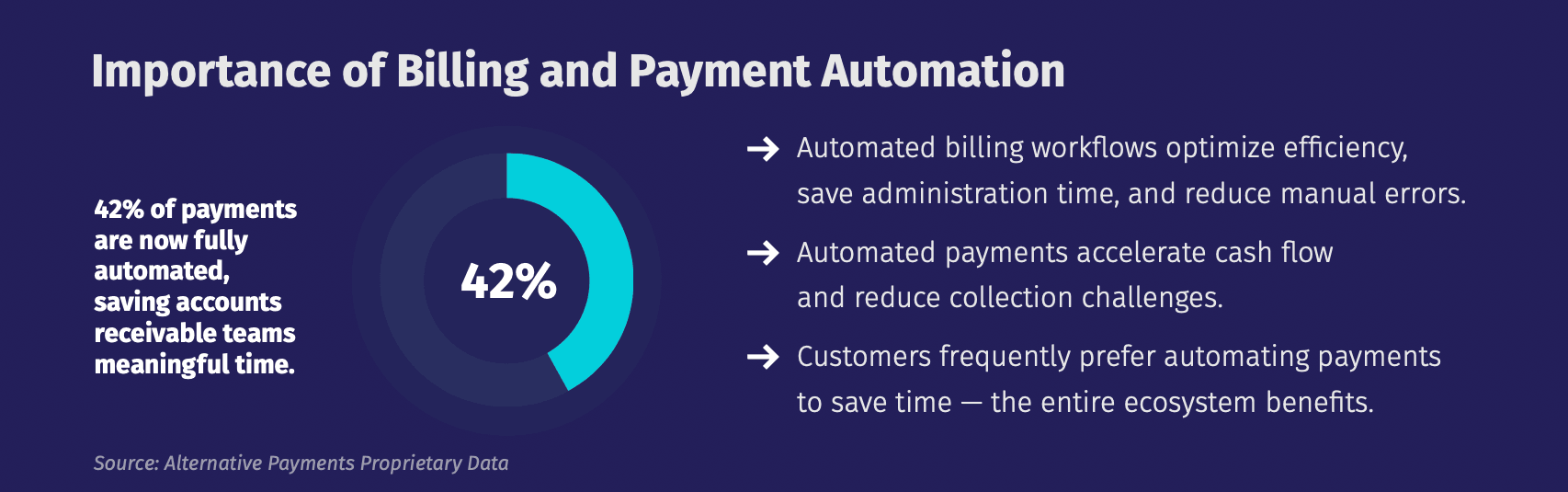

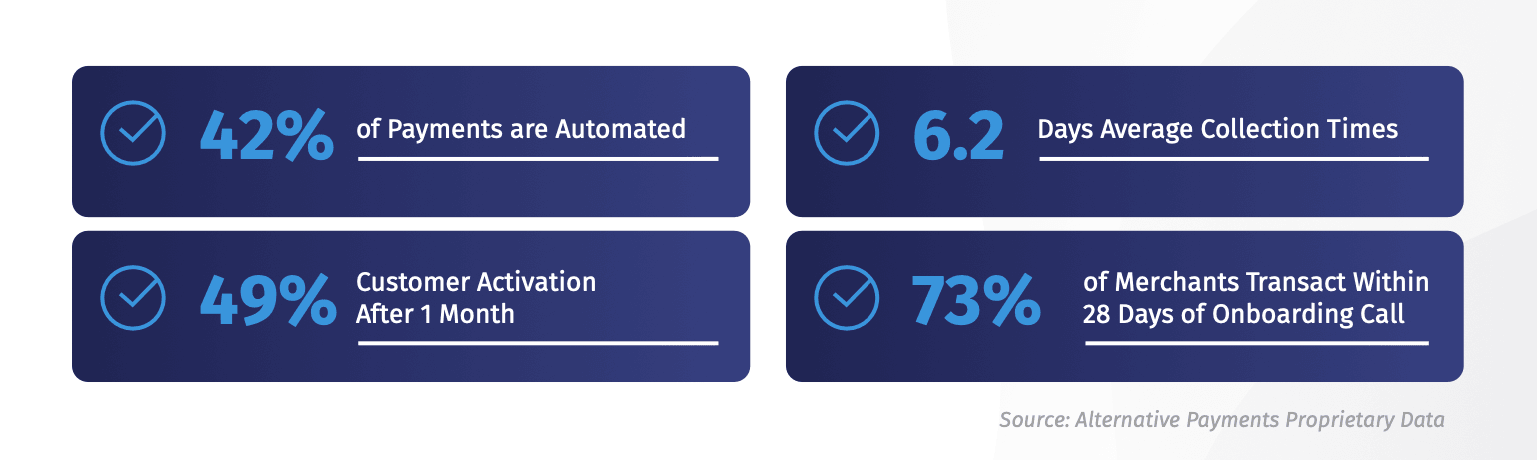

- Automation: From sending reminders to auto-charging customers, AR software automation features cut down manual work and accelerate collections.

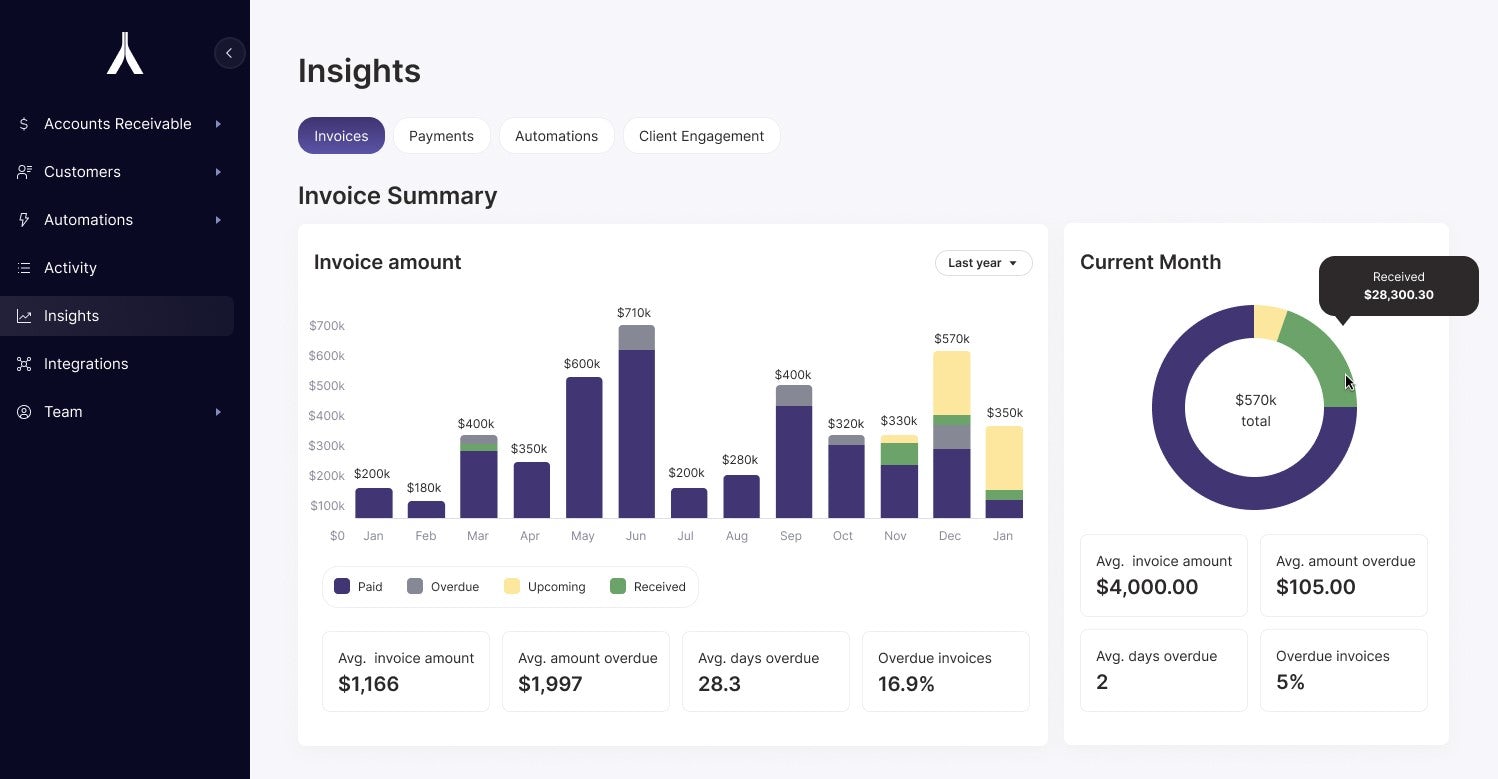

- Reporting and Analytics: Accounts receivable software offers reports on outstanding invoices, payment history, and the account status of customers. This is beneficial to making sound financial decisions for your business.

- Integration Capabilities: Easily integrate into CRM, ERP, and accounting software with the mechanism to synchronize nearly all financial data. Better yet, data is king, right? Its clean data is king — let that be at your disposal without error, or time and resource consumption.

Benefits to Service Businesses

- Cash Flow Boost: With faster invoicing and quicker collections, accounts receivable software directly impacts a business’s cash flow; thereby, enabling timely receipt of funds.

- Customer Satisfaction: Providing customers with options and an easier payment process is the added value that makes a superior customer experience, leading to more return business.

- Operational Efficiency: Automation and integration competencies lower the amount of required manual work; thus, allowing efforts toward more strategic tasks.

Accounts Payable Software: Streamlining Vendor Payments and Expenses

Definition and Purpose

Accounts payable software is tailored to manage the money a business owes its suppliers or vendors. It ensures that liabilities are accounted for, processed, and paid timely to maintain relations and financial standing with vendors.

Key Features in AP Software

- Invoice Processing: Accounts payable software automates capturing, tracking, and paying vendor invoices while providing accuracy to liabilities management.

- Payment Automation: Avoid the risks of delayed payment by automating the scheduling and processing of payments. Often, AP solutions will offer companies the ability to take advantage of early payment discounts, if at all.

- Expense Management: This is a tool generally found in AP software. It is equipped to monitor the classification of a company’s expenses and improve the planning and budgeting of its finances.

- Vendor Management: AP software nurtures relationships with vendors and helps alleviate the potential downside risk of unstructured technology procurement.

- Compliance: Accounts payable software assists in following up with different regulations and standards for security and compliance that create an incremental degree of complexity when it comes to processing payments.

Benefits to Businesses

- Control of finances: Tech platforms provide more visibility into a company’s liabilities and enable cash flow control flow within the scope of financial planning.

- Streamlining Vendors: Automate routine processes that need to be integrated with other financial systems, decreasing the potential for human errors.

- Timely & Accurate: On-time payments ensure more satisfactory relationships with vendors which can enhance your associated terms and costs.

Accounts Receivable vs Payable Software in the Context of Alternative Payments

Alternative Payments platform streamlines revenue collection, end-customer payment experiences, and incoming cash flow, while AP software optimizes vendor payments and outbound cash flow.

Comparative Analysis: Accounts Receivable vs Payable

Comparing accounts receivable vs payable, both solutions provide critical financial management tooling and important clarity on incoming and outgoing cash. Accounts receivable software solutions have a more profound impact on the business in the direct impact on revenue — mind you, unless your business is in the red, this will always be a larger number than expenses, let alone vendor payments. Additionally, it touches on client relationships, which are the heart and soul of a business. Combining various payment methods, alongside automation and reporting: accounts receivable software unlocks significant value for services-based businesses.

In the case of Alternative Payments, accounts receivable software becomes a business-critical tool to enable efficiency and optimization of business processes and operations — a direct contributor to a growing business that delivers a best-in-class customer experience.